Do we know how many African fintech companies have reached scale?

Scale is often deemed a yardstick of success by investors, policy makers and practitioners. So it follows that we should be able to answer this question, right? However, this is not as simple as it may seem.

There is established knowledge in academia on innovation, take-off and technology diffusion but very little where the context is set by both (a) digital initiatives and (b) emerging economies. This absence of knowledge, especially with respect to data-based insights, led to the development of this project’s scope with our co-sponsors, the UK Foreign, Commonwealth & Development Office. Given our team’s experiences in creating and growing digital businesses, we grounded this research with the ‘so what?’ question in mind. Can we see factors linked to scale that are actionable for at least one of the three main actors in the fintech ecosystem – entrepreneurs, investors and policy makers?

We selected financial services companies which are reliant on digital technology as a core aspect of their proposition, and built our list of fintechs using Briter Bridges’ Fintech Intelligence platform, as well as other sources, such as GSMA’s annual State of the Industry Report on Mobile Money[1][2]. We asked ourselves (and the data) some hard questions, starting with two basic ones: how do we measure scale and how prevalent is it? Subsequent papers will look at causal factors but first we need to set ground rules for considering scale.

Why fintech and scale is important but complex?

With over 700 fintech companies in Africa and close to $1bn raised in financing for this sector in 2019[3][4], it is clear that this is a fast-growing and exciting space. Indeed, digital applications in emerging economies hold much promise with hundreds of millions of mobile savvy customers[5][6], and many thousands of small informal businesses increasingly seeking alternatives to old-world banking models. We know that digital solutions, supported by improved GSM and wifi network coverage, can enable the leapfrogging of traditional infrastructure to lighter touch, lower cost and more efficient regimes.

Surely, we’ll find lots of scale…

However, the journey to these sunny digital uplands isn’t easy. The practicalities of implementation are complex especially where an interface between cash and e-money still needs to be designed into an initiative. Fragmentation exists across Africa’s many legislative jurisdictions. The only consistency is difference; Africa is not one playing field. There may seem to be large addressable markets on the face of it, but disposable income is relatively low on average and highly skewed. Growing a successful large business that serves lower income tiers is notoriously hard. Fintech is also not one thing. Infrastructure and services are both bundled into fintech but are as different as chalk and cheese and must be broken out for any sensible analysis to take place. Clear distinguishing features exist around other fintech sub species: payments, credit, international remittances…to name a few.

Understanding this complexity is a pre-requisite to getting anywhere near finding data-based insights.

Turning to scale and measuring it

The concept of “scale” is not an exact science. The paucity of good quality market data combined with the obvious fact that a lot of company-specific data is too sensitive to be in the public domain, makes it clear why most work on scale has relied on a qualitative, case-study approach. We were determined to push for a more quantitative approach.

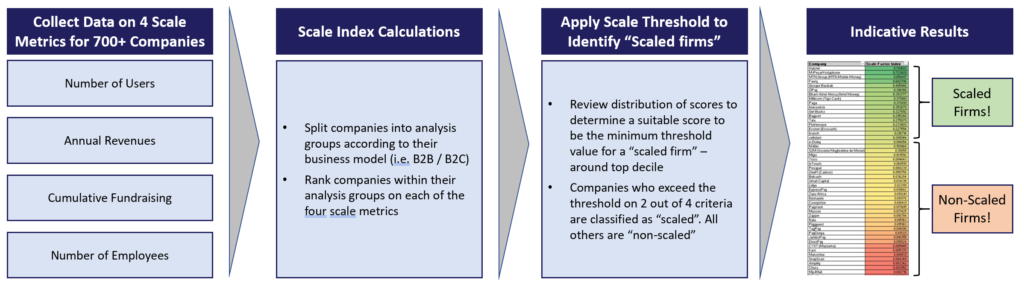

We created a Scale Index methodology using four metrics that in most people’s eyes have a close relationship with company-level scale: number of end users; annual revenue; cumulative amount of fundraising; and number of employees. We’ve been able to include 700+ fintechs operating in Sub-Saharan Africa within our index analysis, breaking fintech into 4 sub segments (payments, lending, infrastructure and services). See inset box.

A range of challenges came up that required figuring out along the way – selecting metrics, classifying companies to sub-segments, splitting out B2Bs vs B2Cs, ensuring data quality– these are just a few. Nevertheless, this is a robust, practical approach that allows us to confidently identify companies that have scaled, and therefore lays the ground for asking the so-what question…why have they scaled?

What does our index show – how many fintechs have scaled?

NB: These results are indicative and may change slightly for our final report published in April.

Our index tells us that between 40 – 50 fintechs in Africa have scaled! That’s 6-7% of our total database of companies. Does this surprise you? With such strong tailwinds for digital growth, is it reasonable to have expected more scaled companies? Or was that an unfair expectation for what is truly still a nascent industry?

[yop_poll id=”1″]

Emergence of the African Lions – Three countries: South Africa, Nigeria and Kenya, are headquarters to ~52% of the total number of fintechs in Africa and ~50% of the total scaled firms. Lagos, Nairobi, Johannesburg and Cape Town are well-established as the major fintech hubs on the continent, able to crowd-in talent and investment.

Strong Sub-Segment Forces at Play – Services and Payment sub-segments together represent ~75% of all fintech companies in Africa, and ~75% of the total scaled firms. Barriers to entry in Services and Payments are relatively low compared to the Infrastructure segment where incumbents with established network power are hard to challenge, and in Lending where companies with deeper balance sheets and more sophisticated technology are harder to replicate.

Next steps

We’re excited to share our full Insights Report on the prevalence of scale in African fintech later in Q1. Sign up here to receive updates directly.

Our second paper will use quantitative analysis to identify factors that consistently contribute to scale. In the meantime, if you are interested to know more or contribute thoughts to this research theme – please reach us on digital.scale@london.edu

[1] Briter Intelligence

[2] GSMA State of the Industry Report on Mobile Money

[3] Partech Partners Africa Tech 2019 VC Report

[4] Briter Bridges Company Dataset – Fintech

[5] GSMA Mobile Economy – Sub-Saharan Africa

[6] Brookings Institute – The Fourth Digital Revolution

Science of Scale is a collaboration project with the Foreign, Commonwealth & Development Office (FCDO) and the Wheeler Institute advancing our understanding of the factors which contribute toward or inhibit the scaling of digital fintech companies in Sub-Saharan Africa.

Project leads:

Nick Hughes, Executive Fellow at the Wheeler Institute, co-founder and Chief Product Officer at M-KOPA and founder of M-PESA. Dr Hughes has been at the forefront of mobile commerce activities in emerging markets for over 15 years, pioneering digital fintech solutions that solve real problems.

Rajesh Chandy, Professor of Marketing, London Business School; Tony and Maureen Wheeler Chair in Entrepreneurship and Academic Director, Wheeler Institute for Business and Development.

Wheeler Institute project team:

Robert Smith MBA2021, Jovin Pizarro MBA2021, Federica Andrisani MBA2021, Zaineb Amin MBA2021, Stephanie Bandyk MBA2022, Catherine Phelps MBA2020, Vilma Nunez MBA2020 and Hamant Maini MIFFT2021.

Charles Freedman

Mike Kelvin

Kileto Olepurko