African History through the Lens of Economics: An introduction to African development and history

Leonard Wantchekon, James Madison Professor of Political Economy and Professor of Politics and International Affairs at Princeton University and Founder and President of the African School of Economics and the Pan African Scientific Research Council, was a regular presence in the Wheeler Institute’s open access online course, African History through the Lens of Economics. In the third week of the course, he discussed his remarkable personal and professional story with Nathan Nunn, Frederic E. Abbe Professor of Economics at Harvard University, Moussa Blimpo, Senior Economist at the World Bank, and Juste Codjo, Assistant Professor of Professional Security at New Jersey City University. Then in the ninth week of the course, he delivered the 31st Annual Kuznets Memorial Lecture, hosted by the Yale Economic Growth Centre, on the subject of political distortions and economic development.

A life spent studying and doing something about political distortions

Professor Wantchekon offers a unique perspective on African history and political institutions, being – in his words – a ‘young child from a peasant family in Central Benin who excelled in math, became a pro-democracy activist, and later a professor of political economy at Princeton,’ who ‘along the way, was expelled from college, spent five years in hiding and eighteen months in prison; escaped and since then has lived in Nigeria, Ivory Coast, Canada and the U.S.’ In the Kuznets lecture, he outlined his longstanding interest in studying and ‘doing something about’ political distortions, first as a pro-democracy activist in Benin in the 1980s and then from the start of his PhD programme at Northwestern University in 1993.

A life of academic excellence began at Doga Vedji (Zagnanado), a modest village, but one which has produced more than thirteen PhDs. After a transfer to Cotonou for middle school, the young Leonard became interested in political activism in 1973 following the assassination of Amílcar Cabral in Guinea. In eleventh grade, he wrote to his brother Ferdinand that he would never be a career academic, after initiating pro-democracy correspondence with international activists; in twelfth grade, he led a student takeover of the school curriculum and teaching after staff were absent for six months. At university, Wantchekon co-founded the Communist Party (PCD) and led another student uprising, which led to his expulsion and a five-year period (1979-84) in hiding as a professional revolutionary, including from 1982 as a member of the shadow opposition government. Arrested in 1985, he was imprisoned and tortured for nineteen months at Ségbana Prison. After persuading a doctor to diagnose him with acute arthritis, he was permitted to visit hospital; on his third visit he escaped, first to Nigeria and then to Canada. There, he completed a Master’s at Laval University, despite not having an undergraduate degree, and then a PhD at Northwestern in under three years.

Political distortions and the impact on growth

When observing the large and persistent differences in living standards across the world and within Africa, we can see the importance of productivity gaps and misallocation (see especially Jones, 2016) as well as disparities in capital and labour. It is also clear that political institutions affect development through their influence on governance and state capacity (as discussed by Besley and Persson, 2009). Professor Wantchekon introduced his Kuznets lecture with these observations and then focused on the following questions:

- what type of institutions are most effective for growth,

- how can these institutions be implemented and

- how important is institutional experimentation?

He began by defining a political distortion as a situation when a political system induces choices that are suboptimal in terms of welfare and development outcomes, noting first that they can affect human capital formation and innovation, capital investment, spatial frictions and resource allocation, and then that they can be complementary to other distortions, for example those related to transportation, information friction and market access.

Where in economic models do distortions feature?

Wantchekon explained that there are several benchmark growth models that include a role for politicians and government. The first is in Barro (1990), which includes public services as a productive input for private producers; these publicly-provided goods are subject to congestion, that are rival but non-excludable. When a producer expands capital and output, they congest facilities for others. In this model, a decentralised economy demonstrates suboptimal growth. A second model is provided by Aghion, Akçiğit and Howitt (2015), where firms innovate until they succeed and then block others’ entry. In this model, democracy represents the probability of a successful innovation resulting in a successful entry, and average productivity growth increases in democracy. Acemoğlu and Robinson (2006) have a consistent position, where political elites block technological innovation for fear of a loss of power, keeping less productive firms in power. Other benchmarks exist, which offer further models whereby political incentives can distort economic outcomes and welfare.

Some important questions that arise from these models are: how does democracy affect public investment, how do political connections affect innovation, market competition and procurement, what are the losses in GDP and welfare, and what types of policies can curb these distortions?

What types of distortion exist?

Wantchekon categorised political distortions into three types: voter-induced distortion, or patronage, firm-induced distortion, or use of political connections, and state capture. Each has been studied by economists in different contexts.

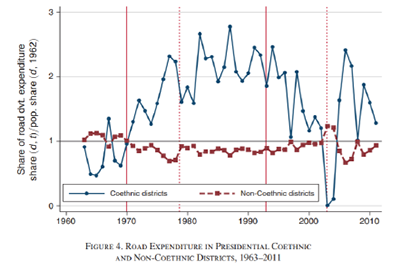

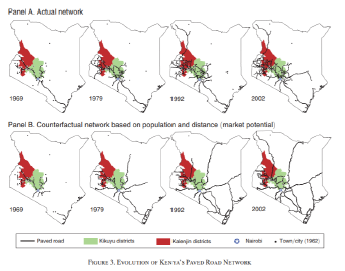

In relation to patronage, some of the questions considered are how democracy affects targeted re-distribution to co-ethnics (see Burgess et al., 2015), how property rights affect investment decisions (Goldstein and Udry, 2008) and under what conditions paternalism towards rural workers is strongest (Beg, 2021). Burgess et al. studied the levels of expenditure on roads in Kenyan districts that were co-ethnic with the government under autocracy in the 1970s and 1980s and then under democracy from 1992 onwards. They found that investment was directed to co-ethnics during the dictatorship, but not under democracy, and they presented a counterfactual road network where investment was based on population and market access. Here, in other words, democracy is important, because it is better at allocating fairly road network investments.

Goldstein and Udry studied cassava and maize production in Eastern Ghana, where it is more productive to leave land fallow every three years but where uncultivated land can be appropriated. They found that those who hold social or political office fallow their land more regularly and, as a consequence, achieve higher profits. In this situation, uncertainty over land rights leads to inefficient total outputs.

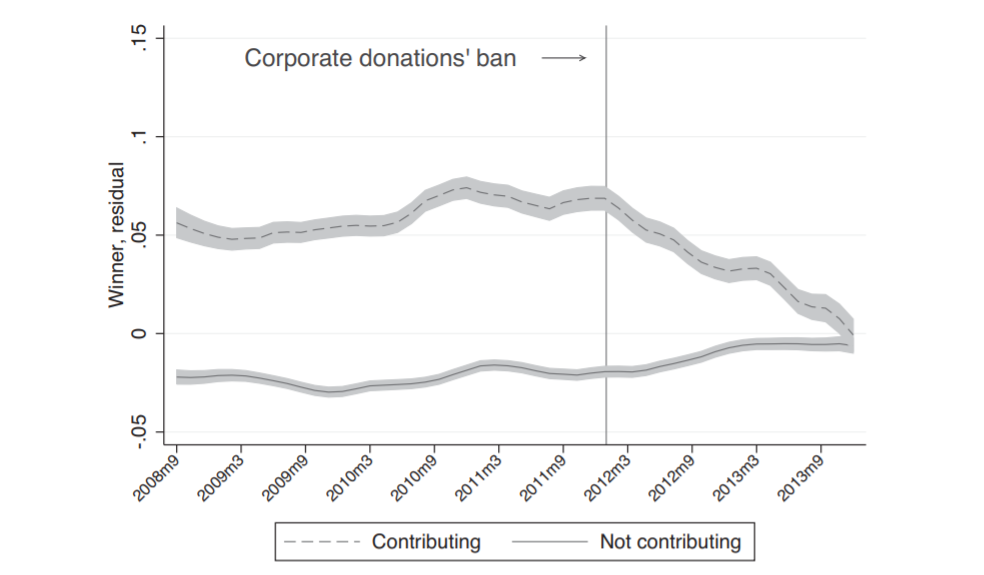

Firm-induced distortions related to political connections have been widely studied. A seminal paper in this field is Fisman (2001), who looked at the relative stock price performance of Indonesian firms connected with President Suharto, when the latter was in poor health. These results have been built upon, for example by Faccio (2006), who used a dataset of more than 20,000 publicly traded firms across 47 countries, seeking to identify firms with MPs, ministers or their close family as large (>10%) shareholders or top officers (e.g. CEO). Connections were common in 35 of the 47 countries. Akçiğit et al. (2018) looked at the effects of political connections on the level of innovation in Italian firms, concluding that larger firms are more likely to be politically connected (since it is costly), older (since they are less likely to exit), but less innovative. In other words, industries with more political connection have less innovation, older firms, and lower productivity growth. Recent attention has focused on how political connections generate distortions, with two mechanisms identified: preferential lending to connected firms (see Khawaja and Mian, 2005) and public procurement being favourable to connected firms (see Baltrunaite, 2020).

Finally, Wantchekon considered a third form of political distortion, namely state capture, where the distortions become systemic and entrenched. ‘Crony capitalism’ is an example of this phenomenon, where political connections are nearly universal and firms are owned or managed by political or military elites. Some recent examples include the Gupta brothers in South Africa and the Bolloré scandals in Togo and Guinea. Canen et al. (2021) considers two elements of state capture. First, they distinguish between direct and indirect capture – control over government officials responsible for policy or control over politicians directing those officials – finding that direct capture is more common is situations of higher electoral uncertainty. Second, they find that increasing competition is not sufficient to curb state capture (since firms switch to direct capture), but that improved selection of politicians and bureaucrats is needed.

What are the remedies for these political distortions?

Wantchekon considered a range of potential remedies for these distortions. One simple implication from the results is that banning political connections and lobbying would be helpful, a position increasingly well supported in theoretical and empirical papers (e.g. Ashworth (2006), Coate (2004), Prat (2002), Baltrunaite (2020), Avis et al. (2022), Gluzar et al. (2022)). Further research has shown the positive effects of increased transparency, technology such as ID cards, digital collection, e-invoicing and voting, regulatory reform and changes in public procurement.

In terms of selecting the right politicians, we can distinguish between demand-side changes, such as improving the amount or quality of information provided to electors, and supply-side changes, for example holding deliberative or Town Hall meetings (see Fujiwara and Wantchekon, 2013, Bidwell et al., 2021) or encouraging non-financial motivations for political entry. One well-studied supply side intervention is the imposition of gender quotas, which have seen increased investment in infrastructure favoured by women (Chattopadhyay and Duflo, 2004), increased competence of male politicians (Besley et al., 2017) and improved perception of women leaders (Beaman et al., 2009).

An interesting area of study is around participative governance inspired by Macedo’s idea of public reason, that ‘those advocating for laws (policies) ought to offer adequate supporting reasons that could be shared by all reasonable members of the political community’ (Macedo, 2011). Conclusions on participatory governance are currently mixed, particularly as the process of decision-making remains opaque. Wantchekon himself is leading a study (RISE Nigeria) into “how constructive dialogues between education stakeholders and politicians influences educational investment, learning outcomes, and support for education outcomes,” leveraging the traditional process of deliberation in African cultures. The three strands of the project involve gathering and disseminating information on policy preferences, deliberation in Education Summits, and the drafting and signing of a Social Contract.

Where next for the study of political distortions?

The Kuznets Memorial Lecture closed with a consideration of possible next steps for research in this field. Professor Wantchekon encouraged the development of unified yet flexible endogenous growth models with generic institutions, quantifiable with newly available data, incorporating features of public finance, contract enforcement and democratic governance, generating socially optimal allocation of public investments, forms and levels of political connections and state capacity, and measuring the welfare effects of political distortions. He closed with an exhortation for political economy to become more prospective and prescriptive, focused on different ways to improve citizens’ engagement with politics and to reduce distortions.

The consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about them, it is hard to think about anything else.

Robert Lucas, Jr. On the Mechanics of Economic Development (1988)

The African School of Economics and future research projects

Wantchekon finished with an exhortation to African scholars to drive this research agenda. He has himself supported such activities by establishing the African School of Economics, of which he remains President, and the Pan African Scientific Research Council. In his conversation with Nathan Nunn, Wantchekon recalled the beginnings of the ASE, including the moment when Angus Deaton asked him whether he appreciated how hard an undertaking he was considering. Undeterred, he focused on the essentials of a high-quality university – curriculum and faculty – and on creating a system rather than a single campus. Since its inception in 2014, the school has placed more than 25 students in PhD programmes and has plans to grow to 25-30 PhD students a year. From its base near Cotonou in Benin, it has already established operations in Cote d’Ivoire and Nigeria, and joint programmes in the U.S., Canada, Nigeria, South Africa and Morocco.

For Wantchekon, there has always been a dual focus on political activism and academic research. He recalled, however, the moment when he made the shift from studying mathematics to specialising in economic history and political science while at NYU. Having a lived experience of growing up near the training camp of the Dahomey Amazons and the site of King Gezo’s death, he realised that he was lucky to be a part of the legacy of the Kingdom of Dahomey. He recommended that all young African scholars should use their own connection to their history for self-discovery, to develop a sense of identity and a pride in who they are, and then to use it as an inspiration for a research project. He identified the privileged position that will allow these young academics to find artefacts and archaeological records that no one has seen or used before and to push research in directions that can shape a positive future for the continent. With Wantchekon and the ASE leading the way, we may all be optimistic of their chances of success.

African History through the Lens of Economics is an open-access, interdisciplinary lecture series to study the impact of Africa’s history on contemporary development by the Wheeler Institute for Business and Development. This course is led by Elias Papaioannou (London Business School), Leonard Wantchekon (Princeton University), Stelios Michalopoulos (Brown University), and Nathan Nunn (Harvard University and supported by CEPR, STEG and the European Research Council. The course ran from February 1 to April 13 of 2022 and has attracted more than 27.000 registrations. For more information visit the course website.

David Jones (MBA 2022) is a Classics graduate and has worked as a teacher in Malawi, an accountant at Deloitte and in the finance function at the Science Museum in London. He completed an internship with the Wheeler Institute’s Development Impact Platform in Zambia over summer 2021 and is now continuing as an intern for the Wheeler Institute, contributing to the creation of content that amplifies the role of business in improving lives.