Identifying the transmission mechanisms of global shocks for better business-cycle management in developing countries

“The emergence of China as the largest official lender has far-reaching implications for developing countries. Understanding monetary spillovers from China makes policy makers better aware of the nature of international shocks in order to make better decisions.”

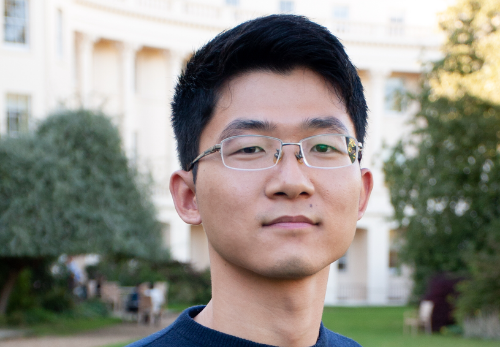

Jinglun Yao, PhD candidate in Economics at London Business School

Developing countries are vulnerable to prevailing trends in the global economy and depend on international financing for infrastructure projects, such as transportation and irrigation, as well as for private business investment. As the largest official lender to developing countries, China is of particular importance and interest in understanding the financing conditions of these countries. Its monetary policy stance is a natural reference point for evaluating development financing in low-income countries. Understanding the real spillovers of its monetary policy is a first-order concern in assessing the impact of international transmission of shocks and business-cycle conditions in developing countries.

The research complements existing literature on US monetary policy spillovers. It sheds light on an important source of fluctuations hitherto unappreciated by academics and policymakers. The authors study how business investments in other countries react to China’s monetary policy shocks due to trade and multinational linkages in a global economy characterised by interlinked production networks. Collation of firm-level data on exports/imports and on foreign ownerships allows the researchers to pin down the transmission mechanisms of shocks, suggesting policy implications for business-cycle management

The potential impact

Understanding the mechanism of China’s monetary policy spillovers is of primary importance for developing countries who depend on international financing. The research goes beyond the usual concerns of US monetary policy and looks at the impact of international monetary policy shocks on development financing in developing countries. Equipped with better knowledge of likely impact of global economic trends, future leaders of developing countries will be better able to cope with challenging domestic economic and financial situations.

Jinglun Yao is a PhD candidate in Economics at London Business School. His research focuses on International Economics and Macroeconomics with an emphasis on firms. He works on theories as well as on empirics which use firm-level administrative data of balance sheet, ownership, international trade and energy consumption. Jinglun has two master’s degrees from the Ecole Polytechnique and a BSc from the Fudan University.

The Wheeler Institute has awarded funding to Jinglun Yao’s research for its business contribution to development in the developing world. Eligible applicants applied for research funding up to £20,000.